A Deeper Dive into Redlining

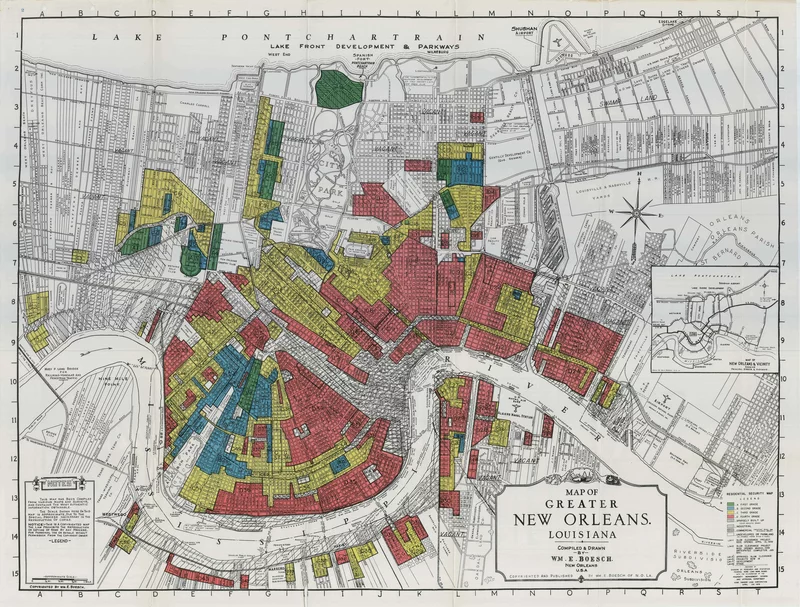

On Monday, we looked into redlining, a policy that restricted investment into neighborhoods dominated by nonwhite residents. This practice, while technically illegal today, still impacts the homeownership of people of color.

This article from Bankrate Mortgage reporter, Zach Witcher, describes in detail the history of redlining, the ways it affects us today, and proposes some steps toward undoing the effects of redlining’s legacy.

Witcher spoke to Rob Rose, former executive director of the Cook County Land Bank Authority in Chicago, who provided some perspective on ways to move away from these discriminatory practices “You’re in a system where there is a ready market of people that can access the system and can afford to access the system, but you systematically charge them more and you make it harder,” Rose said. “If you remove those barriers, how much more steam will our economy be able to pick up if you allow them equitable access?”

Rose likened the current mortgage borrowing and lending practices to the way people of color have been discriminated against in the world of professional sports.

“Where we are with mortgages sort of reminds me where we were with sports 50 or 60 years ago,” Rose said. “African Americans weren’t allowed to participate in professional sports, and to the extent that we were able to break those professional barriers, sports became a richer, fuller experience for everyone.”

This interactive map shows the way the Home Owners Loan Corporation (HOLC) graded cities in the U.S on their “desirability,” after the Great Depression. The city closest to Silver City featured on the map is El Paso, Texas. Take a look at the way different areas within El Paso are graded. This map allows you to see the reasons for the different classifications (“hazardous”, “desirable,” “declining,” etc).

Did anything on the map surprise you? Share your thoughts with us in a comment below.

-Your friends at Undoing Racism